Solutions and Services

From banking to self-order & checkout, we make great human experiences. Learn more about our solutions designed for branches, retail, hospitality and travel, and tap into our managed services and professional services to take your game to the next level.

Banking Experiences Designed for Branches

Our in-branch banking solutions provide the platform for financial center transformation. Whether you want to create convenient cash access, offer automated, full service banking, enable efficient and secure cash management or extend customer service hours with core integration and video-enabled teller and banker solutions, Hyosung Innovue has you covered.

Banking Experiences Designed for Retail

Our banking solutions designed for retail provide the platform for banking convenience outside of traditional financial centers. Whether you want to create convenient cash access, offer easy cash-in, enable efficient and secure cash management or drive foot traffic via alternative financial services, Hyosung Innovue has you covered.

Self Order & Checkout Experiences

Our in-store point of sale solutions deliver frictionless shopping experiences while driving operational efficiency for any size retailer. Whether you want to enable self-service order/checkout, vending automation, efficient and secure cash management or drive foot traffic via alternative financial services, Hyosung Innovue has you covered.

Consumer Experiences

Reimagining human experiences at ATMs and other self-service moments, so they are more fluid, more seamless, and more equitable.

Tango spans banking, retail, hospitality, gaming, hospitality and healthcare to create convenience and keep people on the go. Tango goes with the flow to make day-to-day moments a delight.

Managed Services & ATM As-A-Service

End-to-end ATM software management, hardware maintenance, monitoring and security turnkey services that allow you to maintain peace of mind while alleviating the burden of your ATM fleet management.

Professional Services

Leverage our team of industry experts to unlock value tied to cash automation, optimize your security platforms and ensure the technology you deploy is operating as efficiently and effectively as possible.

Featured Products

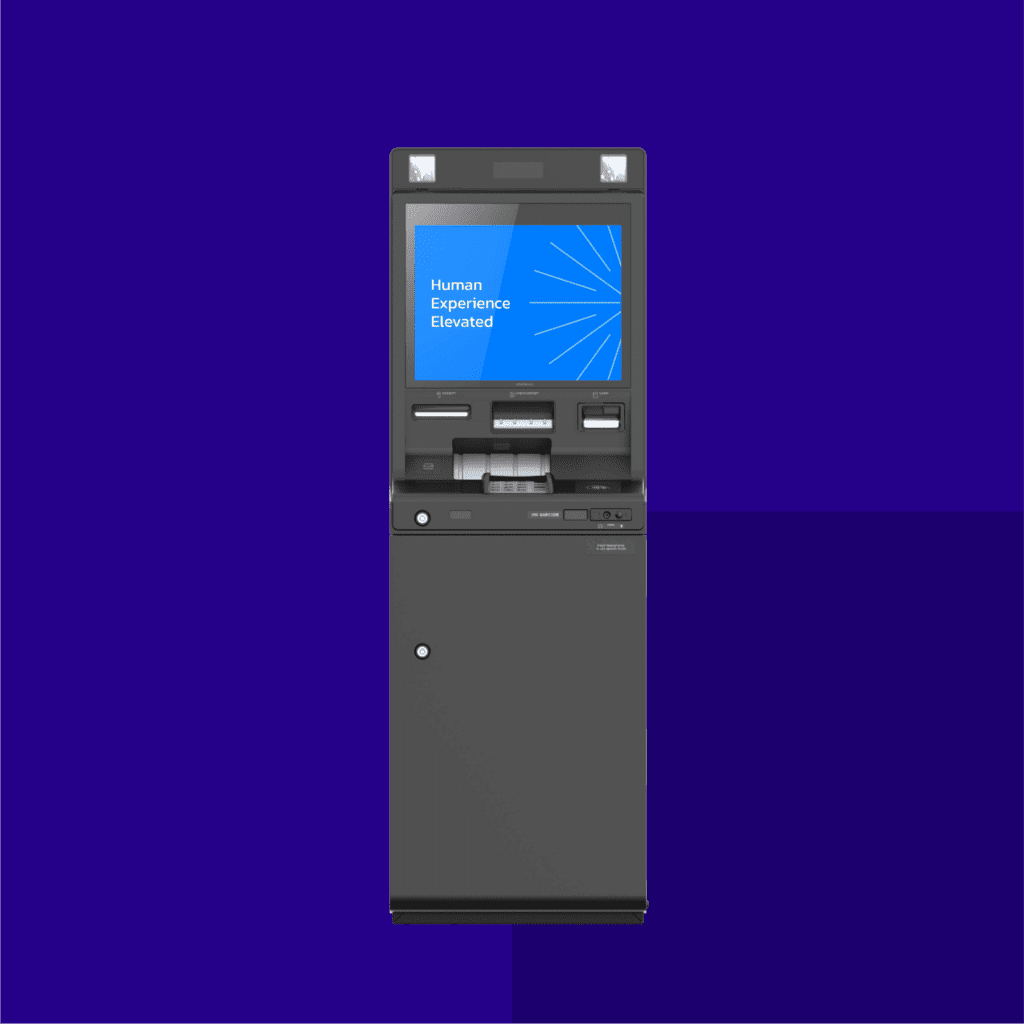

Hyosung 9L

The Hyosung 9L combines state-of-the-art self-service capabilities with the latest advances in cash automation to deliver the pinnacle in branch transformation technology. A robust set of transactions provides access to a wide range of banking needs through Hyosung’s industry-leading core integration solutions.

MS500

The MS500 is a digitally secure, fast and feature-rich cash recycler for financial institutions. The MS500 modular design and high capacity cassettes drive Hyosung’s industry-leading availability and serviceability.

Related Insights

Check out some of our relevant blogs, news, and industry articles.

Hyosung TNS Appoints Bryan Choi as CEO

IRVING, Texas—Hyosung TNS Inc., the parent company of Hyosung Americas and a global industry leader in financial technology innovation, proudly announces the appointment of Bryan Choi as CEO, effective July 19th. Bryan Choi, 61, brings a wealth of global experience and a strong technology background to Hyosung TNS. A graduate of Seoul National University with […]

Hyosung’s TangoCafe Earns Honorable Mention at the Viddy Awards

May 2024 – We are thrilled to announce that our video of the TangoCafe in action, featured at the recent NAMA show, has received an Honorable Mention at the esteemed Viddy Awards, presented by the Association of Marketing and Communication Professionals (AMCP). The Viddy Awards have been a cornerstone in recognizing excellence in video production […]

Our Evolving Payment Ecosystem

Bill Budde is the Vice President of FI Strategy for Hyosung. In this role, he helps banks and credit unions make decisions about branch transformation technology and unlock the value of those investments. Prior to joining Hyosung, Bill worked at JPMorgan Chase in both the Retail Banking and Merchant Processing business units, developing and implementing […]